All Categories

Featured

Investing in tax obligation liens through acquisitions at a tax lien sale is just that-a financial investment. All Tax Sales in Colorado are carried out per CRS 39-11-101 thru 39-12-113 Adhering to the tax obligation lien sale, effective prospective buyers will receive a copy of the tax lien certification of purchase for each residential or commercial property. Investing in tax liens via purchase at the tax lien sale is simply that, a financial investment.

Profit By Investing In Real Estate Tax Liens Pdf

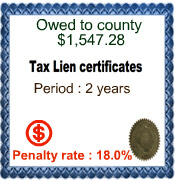

The passion rate is 15%. Passion is built up regular monthly and is paid at the time the certification is retrieved. The certification owner can make an application for a deed three years after the date of sale if the proprietor has not retrieved the certificate. No telephone, fax, or mail bids are approved. Region certificates can be designated to individuals for a$4.00 assignment charge. The County held certificates are published in our workplace and the area notice board in the Courthouse. We additionally post it on our site. Enrollment will certainly be open for the customers the day of sale up till sale time. Our office keeps the original Tax Lien Sale Certificates on data. This is a benefit to the capitalists for.

numerous reasons. In the instance of redemptions, it speeds up obtaining your refund to you. At recommendation time in August, all you have to do is send out in your check along with the appropriate paperwork. When a home owner falls back in paying property taxes, the area or community might place tax lien against the property. This ensures that the home can't be.

re-financed or marketed up until the tax obligations are paid. Rather than awaiting settlement of taxes, federal governments occasionally decide to offer tax obligation lien certificates to private capitalists. As the owner of a tax obligation lien certificate, you will obtain the passion settlements and late charges paid by the property owner. best book on tax lien investing. If the homeowner does not paythe tax obligations and charges due, you have the lawful right to foreclose on and take title of the home within a specific period of time (usually two years) (real estate tax lien investing). Your income from a tax obligation lien financial investment will come from one of 2 resources: Either rate of interest payments and late charges paid by house owners, or repossession on the residential property occasionally for as little as cents on the dollar.

Latest Posts

What Is Property Tax Sale Auction

Tax Delinquent Properties

How To Tax Lien Investing