All Categories

Featured

Table of Contents

It's crucial to bear in mind that SEC regulations for accredited investors are created to protect capitalists. Without oversight from financial regulators, the SEC just can't review the risk and incentive of these investments, so they can't offer information to educate the typical financier.

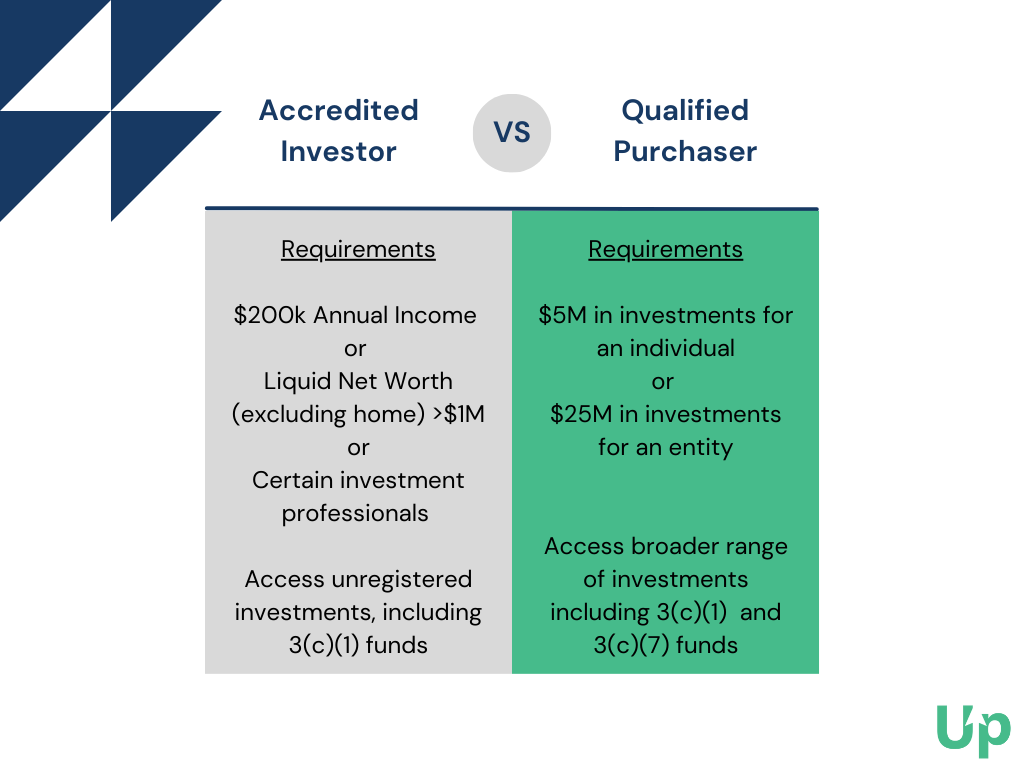

The concept is that investors who gain adequate revenue or have enough wealth are able to take in the threat much better than capitalists with reduced revenue or much less wealth. accredited investor investment returns. As a recognized financier, you are expected to complete your very own due diligence before including any kind of asset to your investment profile. As long as you meet among the adhering to four demands, you certify as a certified financier: You have actually earned $200,000 or even more in gross earnings as a private, each year, for the past 2 years

You and your spouse have actually had a mixed gross revenue of $300,000 or even more, annually, for the previous 2 years. And you expect this level of earnings to continue. You have a total assets of $1 million or even more, omitting the value of your primary residence. This indicates that all your possessions minus all your debts (omitting the home you reside in) complete over $1 million.

Acclaimed Accredited Investor Crowdfunding Opportunities

Or all equity owners in the business certify as recognized financiers. Being a recognized financier opens doors to investment opportunities that you can't access or else.

Becoming an approved investor is just a matter of showing that you fulfill the SEC's demands. To verify your income, you can offer documentation like: Tax return for the previous two years, Pay stubs for the past 2 years, or W2s for the past two years. To validate your total assets, you can provide your account statements for all your assets and obligations, consisting of: Cost savings and examining accounts, Financial investment accounts, Outstanding lendings, And property holdings.

Cost-Effective Accredited Investor Alternative Asset Investments

You can have your attorney or CPA draft a verification letter, validating that they have actually examined your financials which you satisfy the requirements for an accredited investor. Yet it may be a lot more cost-efficient to use a solution particularly made to verify certified financier standings, such as EarlyIQ or .

, your recognized capitalist application will be refined via VerifyInvestor.com at no expense to you. The terms angel financiers, sophisticated capitalists, and certified capitalists are typically made use of mutually, yet there are refined differences.

Normally, any person who is certified is thought to be an innovative investor. Individuals and service entities that maintain high earnings or large wide range are presumed to have sensible knowledge of money, certifying as advanced. Yes, worldwide capitalists can become recognized by American monetary requirements. The income/net worth requirements continue to be the exact same for international financiers.

Right here are the best financial investment chances for accredited financiers in property. is when capitalists merge their funds to purchase or restore a residential or commercial property, then share in the proceeds. Crowdfunding has turned into one of one of the most prominent approaches of purchasing realty online because the JOBS Act of 2012 allowed crowdfunding systems to provide shares of real estate projects to the public.

Custom Accredited Investor Investment Opportunities

Some crowdfunded realty investments do not require certification, yet the tasks with the best potential incentives are commonly booked for accredited financiers. The distinction between projects that accept non-accredited capitalists and those that only approve recognized financiers generally boils down to the minimum financial investment amount. The SEC currently restricts non-accredited capitalists, who earn less than $107,000 per year) to $2,200 (or 5% of your yearly revenue or total assets, whichever is less, if that quantity is greater than $2,200) of investment capital each year.

is among the very best ways to purchase realty. It is extremely comparable to genuine estate crowdfunding; the process is essentially the same, and it comes with just the same benefits as crowdfunding. The only significant distinction is the ownership framework. Property syndication uses a stable LLC or Statutory Count on ownership version, with all capitalists working as members of the entity that owns the underlying property, and a syndicate who assists in the task.

a company that purchases income-generating realty and shares the rental income from the properties with capitalists in the kind of rewards. REITs can be publicly traded, in which instance they are regulated and readily available to non-accredited investors. Or they can be personal, in which situation you would need to be certified to spend.

Trusted Accredited Investor Investment Networks

It is very important to keep in mind that REITs typically include numerous costs. Monitoring charges for a private REIT can be 1-2% of your total equity annually Purchase costs for new purchases can pertain to 1-2% of the acquisition price. Administrative charges can amount to (accredited investor high return investments).1 -.2% annually. And you might have performance-based fees of 20-30% of the private fund's earnings.

While REITs concentrate on tenant-occupied residential properties with secure rental revenue, private equity genuine estate firms focus on genuine estate advancement. These firms usually create a story of raw land into an income-generating residential property like an apartment complex or retail shopping mall. Just like exclusive REITs, financiers secretive equity endeavors generally require to be accredited.

The SEC's meaning of accredited capitalists is designed to identify people and entities regarded monetarily advanced and efficient in assessing and taking part in specific kinds of private investments that may not be readily available to the basic public. Importance of Accredited Investor Status: Final thought: Finally, being a certified investor carries significant relevance in the world of financing and investments.

Five-Star Accredited Investor Opportunities

By satisfying the criteria for recognized investor condition, individuals show their financial refinement and access to a world of investment chances that have the possible to produce considerable returns and add to lasting monetary success (accredited investor crowdfunding opportunities). Whether it's investing in start-ups, property ventures, personal equity funds, or various other alternative assets, approved financiers have the opportunity of exploring a varied variety of investment options and constructing wealth by themselves terms

Accredited investors consist of high-net-worth people, financial institutions, insurer, brokers, and depends on. Approved capitalists are defined by the SEC as certified to invest in complex or advanced sorts of safeties that are not very closely managed. Certain standards have to be satisfied, such as having an average annual income over $200,000 ($300,000 with a spouse or domestic companion) or functioning in the financial industry.

Non listed protections are inherently riskier since they do not have the normal disclosure needs that come with SEC enrollment., and numerous deals including complex and higher-risk financial investments and tools. A company that is looking for to increase a round of funding may determine to straight come close to certified capitalists.

Table of Contents

Latest Posts

Strategic Real Estate Overage Recovery Approach Tax Overages

Tax Lien Sale Properties

Preferred Accredited Investor Funding Opportunities with Accredited Investor Returns

More

Latest Posts

Strategic Real Estate Overage Recovery Approach Tax Overages

Tax Lien Sale Properties

Preferred Accredited Investor Funding Opportunities with Accredited Investor Returns